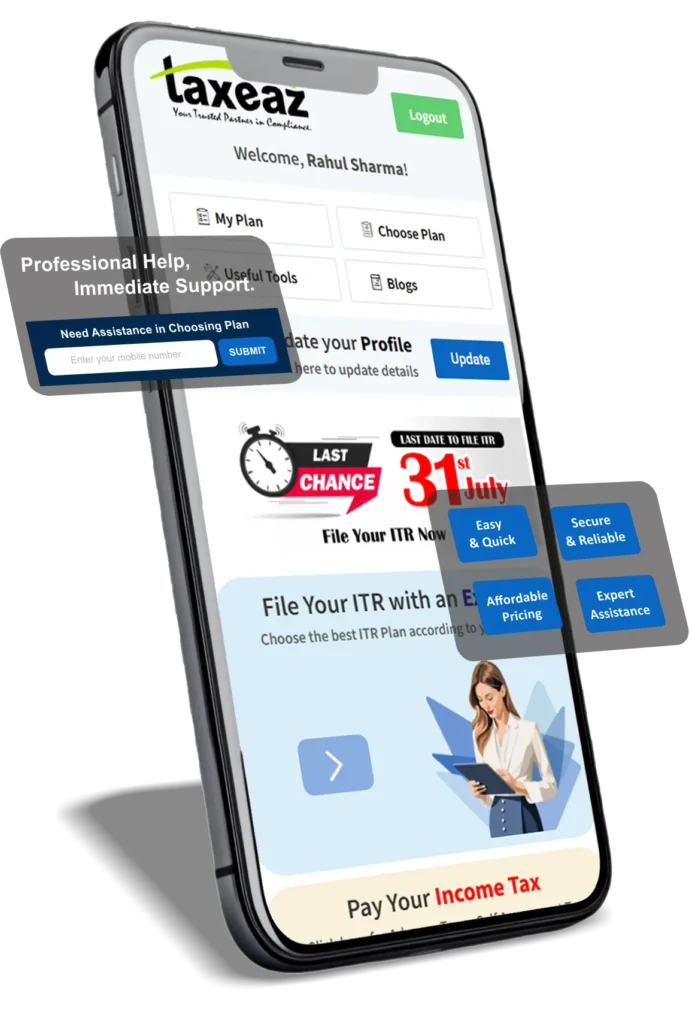

Online ITR filing with TAXEAZ Anytime, Anywhere!

Get expert-backed, secure, and convenient tax solutions.

Connect to Expert

Get your ITR filed by experienced tax professionals—fast, accurate, and designed to save you more.

Connect NowEasy & Quick

File your ITR in just a few clicks.

Secure & Reliable

Your data is encrypted and 100% safe.

Expert Assistance

Get support from experienced professionals.

Affordable Pricing

Transparent and budget-friendly plans.

Calculate Your Tax Liability

Easily determine your tax liability with accurate calculations based on the latest tax rules. Get a clear estimate of the taxes you owe and plan your finances better!

Affordable Pricing, Maximum Benefits

Pick the Best ITR Filing Plan as per Your Requirement

Salary ITR

Basic Plan- Multiple Employer

- Salary Income

- House Property Income

- Interest Income (Bank / FD)

- Agricultural Income

- Income Computation

Salary ITR

Standard Plan- Multiple Employer

- Salary Income

- House Property Income

- Interest Income (Bank / FD)

- Agricultural Income

- Income Computation

Business ITR

Basic Plan- Business Income (Non Audit)

- House Property Income

- Interest Income (Bank / FD)

- Agricultural Income

- P & L and Balance Sheet

- Income Computation

Business ITR

Standard Plan- Business Income (Non Audit)

- House Property Income

- Interest Income (Bank / FD)

- Agricultural Income

- P & L and Balance Sheet

- Income Computation

Need help choosing the right plan?

Share your number for a quick call!

Knowledge Insights

Professional Support, Expert assisted ITR filing

Our experts ensure your tax filing is accurate and hassle-free, helping you maximize tax savings. With our dedicated support, you can file with confidence and ease!